|

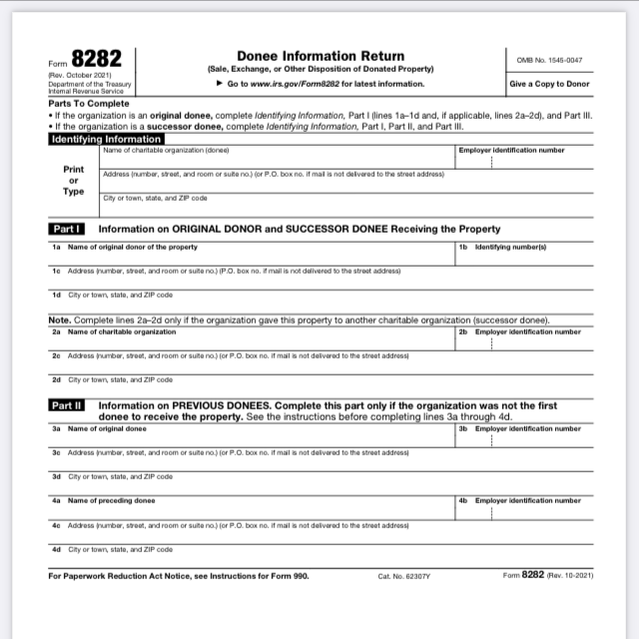

Form 8282 Donee Information Return

Most charities liquidate bitcoin and cryptocurrency once received and when they do so they need to complete and file Form 8282 with the IRS. This form must be sent in 125 days from the date of disposition and can be sent in seperately from any other tax filing. Charity Obligation when donated Bitcoin is received The charity must give the donor a thank you letter for the Bitcoin donated. The IRS gives charities requirements for these thank you letters here. If the Bitcoin is liquidated then the charity must file a Form 8282 Donee Information Statement within 125 days from the date of disposition as a stand alone filing with the IRS. If the charity files a 990 with the IRS the charity needs to file a seperate Schedule M with their 990 filing for the year in which the bitcoin was received.

0 Comments

Leave a Reply. |

AuthorRandy Tarpey CPA Archives

January 2024

Categories |

Copyright © 2015

RSS Feed

RSS Feed